Yield Farming -a quick overview

Anyone who follows DeFi developments has probably heard of Yield Farming. It doesn’t involve toiling over a field in the sun, but instead, the term ‘Farming’ originates from the huge returns you could potentially gain (farm) from this strategy. You essentially put your tokens to work, staking or lending your assets to liquidity pools, facilitating transactions for other borrowers who need the liquidity to perform trades online.

Yield farming is notorious for carrying more risk than petting an angry porcupine, and is a strategy newcomers to crypto should give a wide berth to. Yield farming requires a substantial amount of capital to reap significant rewards, which means even greater risk.

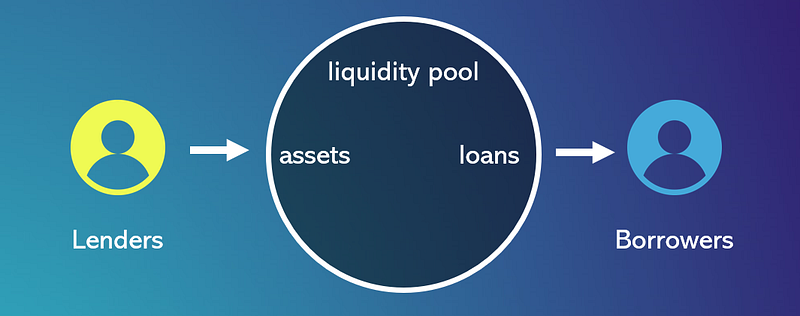

Before we dive into terms like APY and TVL, we need to know how lending protocols work. A yield farmer deposits his funds into a lending protocol, which is essentially a liquidity pool -a bunch of assets locked up using a smart contract. Users who need these funds can then borrow them from the pool using prices that are fixed via algorithms, instead of a centralized agency. These users pay the platform for facilitating these trades, and a percentage of those payments is distributed to liquidity providers. The more funds you deposit, the more you are rewarded.

Here’s a helpful diagram

The most popular terms associated with yield farming are:

Total Value Locked (TVL)

The TVL denotes the total value of the assets that have been staked in a particular protocol. For instance, if 10 users contribute 1 BTC each, then the total value locked is 10 BTC.

Another useful ratio is the TVL Ratio.

Market Cap = (Circulating Supply) x (Current Price)

TVL Ratio = (Market Cap)/(TVL)

The TVL Ratio helps understand whether an asset is undervalued or overvalued. A TVL Ratio < 1 generally implies undervaluation, although this might not always be the case.

Annual Percentage Yield (APY)

APY measures the rate of return on an investment with the compounding interest taken into consideration.

If your investment was $100 and it compounded at 5% every 6 months, the total money you’d have at the end of the year would be $110.25. Your APY is thus 10.25%, not 5%.

Annual Percentage Rate (APR)

The APR measures the interest rate you’ll be charged at when you borrow an asset. The APR also takes other costs into account, such as insurance or lending fees. The APR is useful when you want to know the exact amount you’ll have to pay back on a loan.

To start, all you need to do is install a software wallet like Metamask or Phantom for the coin you want to farm with, and load up some assets in it. You then head over to a yield farming website and connect your wallet to it. All platforms provide detailed instructions on their website about how to find a farm, provide liquidity, harvest your yield, and exit the farm.

You can head over to https://defillama.com/ or https://coinmarketcap.com/yield-farming/ to find a suitable yield farm for the token you’d like to use. For instance, Raydium has the highest TVL among Solana projects.

Is this the part where you tell me to be careful and not YOLO grandma’s Christmas present money away?

Absolutely.

Smart contracts are fairly safe, but that doesn’t mean they can’t be hacked. DeFi is very young, and rapid developments and changes are always around the corner. Some projects themselves might be scams promising impossible APYs to lure gullible users.

You also run the risk of impermanent losses, where Automated Market Makers (AMMs) might lag behind when it comes to updating token prices from a centralized exchange. These tiny differences could lead to some big consequences. One of the ways to mitigate this risk is to only use protocols that trade using assets with lower price slippages (price drops).

At the end of the day, most DeFi projects won’t work. Its important to do your own research and know the risks Yield Farming carries with it before you dive in.

Disclaimer: This post is not financial advice

Point Network is creating the future of the web. Join our telegram at https://t.me/pointnetworkchat