ICOs to IDOs -a quick recap

The year is 2018. The Bitconnect coin is among the world’s top 20 most successful coins, promising ludicrous 1% daily compound interest pay-outs. Not surprisingly, it turns out to be a Ponzi scheme, costing its investors almost $2.5 billion. In hindsight the only question is, how did it go on for so long? Even giants like Telegram conducted botched token sales, being ordered by the Securities and Exchange Commission to pay $1.2 billion back to its investors. If you thought the majority of ICOs (Initial Coin Offerings) seemed to be complete frauds, you’d be proven right by a study from Statistic Group Research, claiming almost 80% of ICO-projects in 2017 turned out to be a scam. Investing in an ICO was like taking the first guess in a game of Minesweeper. There had to be a better way.

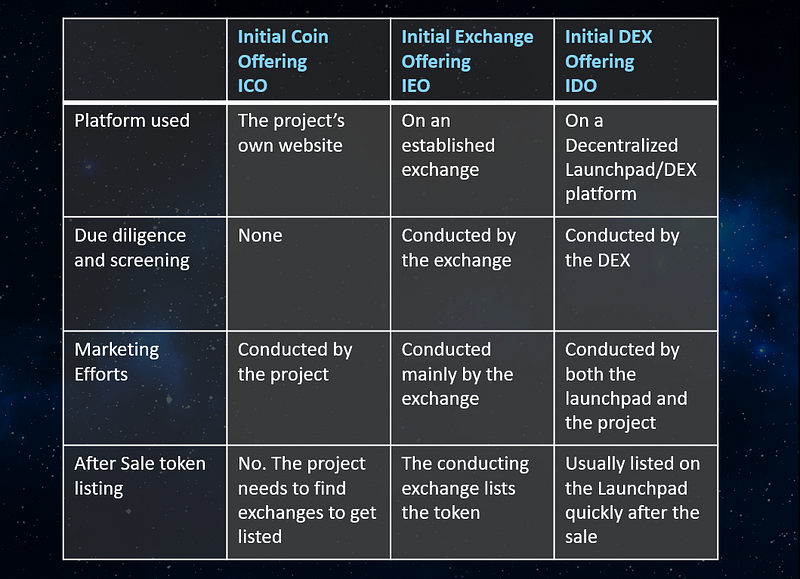

This is the time crypto exchanges realized they already have hordes of investors with money, jacked to the gills with a common affliction known as FOMO. Cryptocurrency exchanges like Binance created their own launchpads, effectively creating IEOs (Initial Exchange Offerings). There were several benefits that an IEO brought to the table. Firstly, my grandma could no longer host an ICO, all projects were thoroughly scrutinized, with only the most robust projects with a high potential getting selected to hold sales on these launchpads. The exchange also started helping projects with various aspects of their business such as marketing and PR work in addition to running Know Your Customer and Anti Money Laundering schemes to make sure projects got genuine customers.

While IEOs certainly seemed more credible than ICOs, projects often had to sacrifice a lot of capital and control in return for increased credibility and protection. The centralized nature of an ICO was also a major hiccup, defeating the entire purpose of creating a decentralized crypto project.

In 2018, like so many other things in the blockchain ecosystem, the idea of a Decentralized ICO was proposed by Vitalik Buterin. Since then, IDOs (Initial Dex Offerings) have been gaining traction faster than Mariah Carey’s ‘All of I want for Christmas’ at the beginning of December.

So, what is an IDO?

Much like centralized exchanges, DEX (Decentralized Exchange) platforms have billions of dollars that are locked away. These huge numbers make crowdfunding on these platforms very viable. DEXs like PancakeSwap and Uniswap started launching projects, and Binance DEX hosted the first-ever IDO.

IDOs in some ways lie midway between ICOs and IEOs. DEX platforms can’t stop firms from listing their project, and listing fees are typically far lower than what a centralized exchange would demand. This allows projects to follow their own vision. Investments in IDO launches use liquidity pairs, like USDT/ETH. Traders on the platform can swap different currencies to gain a particular token that is being launched. This combined with a vesting period that is generally applied to private investors makes high price fluctuations far more unlikely, allowing traders to purchase coins with a lot more confidence.

Sounds like the best thing since sliced bread, I can’t wait to dive in.

Remember though, the DEX has no control over the launch. IDOs also focus on smaller token sales, and many are vastly oversubscribed, meaning projects often must resort to methods like a lottery system, which in turn means not everyone can participate. While unlikely, these tiny volumes of tokens coupled with IDO’s instant liquidity could create price fluctuations.

IDOs offer a way for everyone to get in on early projects. Or at least try. Remember to do your due diligence before investing, and don’t YOLO the college fund away.

Disclaimer: No blog or social media posts by Point Network are financial advice.